The complying with concepts are planned to give you concepts to begin your economic preparation journey. When you make the decision to make economic preparation part of your day-to-day regimen, it will certainly not show up so difficult. Beginning your economic journey could be the hardest point. These ideas will absolutely help encourage you to make economic intending one of your primary purposes.

Idea # 1 – Pay off Financial obligation

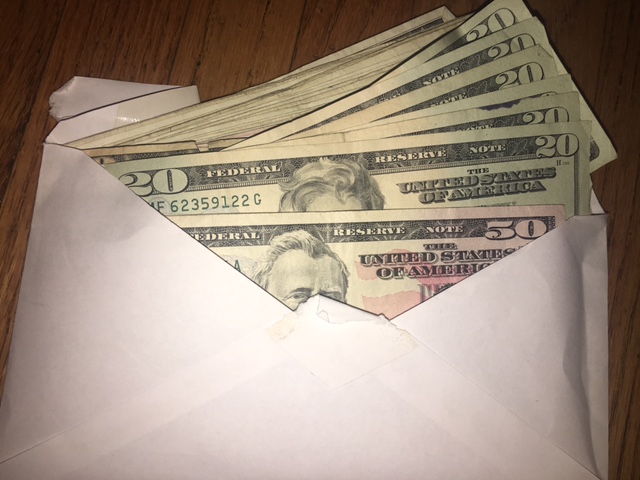

One of the most significant facets fighting against monetary planning is individual debt, specifically bank card personal financial obligation. If something starts as a little personal financial debt it could turn into a larger debt as a result of the truth that you were not reducing the debt frequently!

Financial preparing suggests you have a strategy and also paying individual debt must be the extremely initial goal of your plan.

The major benefit of minimizing and also repaying your financial obligations is that you after that have even more cash to spend for your future. In addition, your living prices become lower since you no more have financial debt payments to make.

Idea # 2 – Start Investing

A crucial principal is to begin investing. Financial preparing indicates that you are conserving and preparing for the future, so you will definitely wish to take cash you make today and acquire financial investments for the long term. Areas you can invest right into consist of the stock exchange, in bonds, IRAs, 4019k) or a blend of all of the above. Saving your cash with the aid of monetary administration and also excellent self-control will absolutely aid your savings to expand.

Suggestion # 3 – Have Goals

In my experience, the number 1 reason individuals don’t save is since they have no goals for the future. Without objectives, there is nothing to motivate you to delay investing today in exchange for a greater advantage in the future.

Take some time to lay out some concrete objectives – things that are very important for you. Maybe a holiday, brand-new vehicle, perhaps even an occupation modification!

Suggestion # 4 Spend Less Than You Make!

This is understandable however not as easy to implement! This is because of the truth that lots of people prefer to purchase brand-new points and also want the most up to date and also greatest TELEVISION, Phone etc without thinking of the long term effects.

Regardless, you can’t prosper monetarily if you’re spending greater than you make. It doesn’t make good sense, does it!

I’ve met some individuals who spend more than they make, and also fund this by enhancing personal debt. This isn’t sustainable and also will only finish laid-up. Which brings me on my following suggestion …

Idea # 5 Know where Your Cash Goes

Budgeting is an additional financial principle that lots of people battle with. You will not have the capability to conserve unless you understand where your money is going and you remain in a position to influence your costs.

You need to make a record of all the money that comes into, as well as out of your family. This may be difficult to do initially, but once you begin it, it obtains much easier over time. It’s not up until you recognize where your money is going that you can start to take steps to re-prioritise your spending to ensure that an appropriate quantity of money is being saved for your future. Learn more financial planning tips in this link, https://www.islandecho.co.uk/the-disadvantages-of-debt-financing/.